5 Tips You Need to Know When Filing Your Personal Taxes in 2021

Taxes. It’s probably one of the most feared words in the English language.

The problem is that most people don’t fully understand tax and that lack of knowledge feels scary and threatening.

That’s why it’s important to trust the experts when you’re filing taxes — especially if you feel you don’t have a solid grasp of all of the details.

Baldip Moore, CPA, CGA, has been helping small businesses and professional services effectively file their personal and business tax returns for decades, and has a deep understanding of the rules and regulations. As a result, his clients don’t pay any more taxes than they need to while seeing efficient savings in the long run.

When it comes to the basics of filing taxes, here are 5 key tips you should know before you begin:

1. Get your documents organized

There is a lot of paperwork that needs to be collected before you begin filing your taxes. It’s not like you can just open up your tax software and plug in the numbers — you will need to do a little bit of homework.

Whether you’re planning on working with a professional accounting firm like Bridex or you want to attempt filing your own taxes, you will need to gather these documents:

- T-slips such as T4, T4A, T5. You can download these from the CRA.

- RRSP documents

- T2202A, if you are a student and pay tuition. You can download this from your university website.

2. Find your RRSP slips for the relevant tax year

One of the biggest mistakes Baldip Moore sees at Bridex when it comes to personal taxes is clients bringing in Registered Retirement Savings Plan (RRSP) slips for the wrong tax year. Many people think that for RRSPs, the tax year is January 1st to December 31st.

Here’s where it starts to get tricky: When filing your taxes, you actually need to provide RRSP slips for any contributions made between last March to this March. For example, for your 2020 tax return, your Registered Retirement Savings Plan (RRSP) slips will need to be from March 1, 2020 to March 1, 2021.

3. Don’t overlook your receipts

If you run a business or have a professional services practice, you can write off a number of expenses — meaning you don’t have to pay income tax on the money you paid for those expenses.

If you had medical procedures or expenses, such as buying a new pair of glasses or going to the dentist, those should also be accounted for in your personal tax filing. Plus, if you made any donations this year, such as to your child’s soccer team or to a worldwide charitable organization, keep your donation receipts to save on your taxes.

4. Set up your CRA My Account

Even if you’re working with a professional accounting firm like Bridex, setting up your Canada Revenue Agency (CRA) My Account is a good idea. This way, you have more visibility into what is happening with your tax return.

Just a few of the things you can do when you have this account set up include:

- Tracking your refund

- Checking your benefits

- Applying for benefits programs such as the Canada Child Benefits or Canada Emergency Response Benefit (CERB)

- Viewing your Registered Retirement Savings Plan (RRSP) and

Tax Free Savings Account (TFSA) contribution room limits

Some of the most common questions tax accountants get have to do with contribution room limits and refund tracking. Having your Canada Revenue Agency (CRA) My Account set up provides you all of this information at your fingertips. While accountants can have some authorization to access your account, they do not have full visibility.

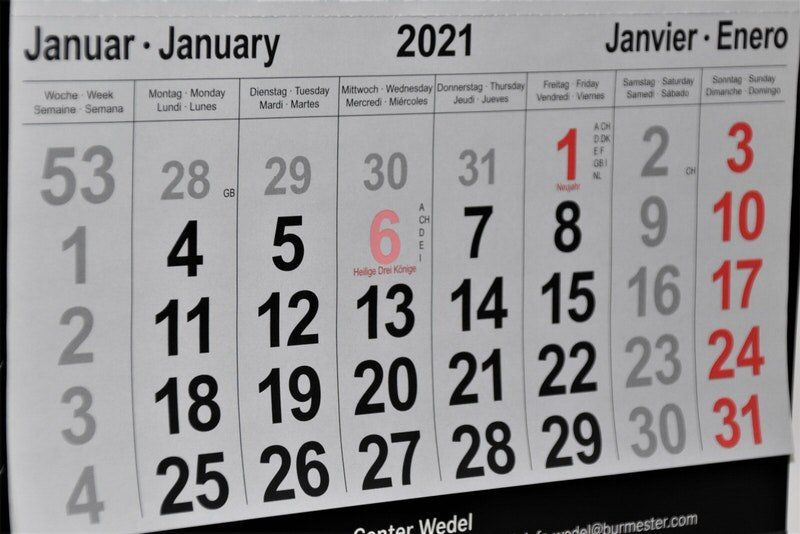

5. Meet the tax filing deadline

When it comes to deadlines and taxes — you’ve got to make it in on time. If you don’t, you can end up facing costly penalties if you owe taxes, and no one wants to pay more than they need to.

In 2020, the Canada Revenue Agency allowed more time for the personal tax filing deadline. However, no extension has been announced in 2021. This means that your individual tax filing is April 30th. If you’re self employed, the filing deadline is June 15th. Note that income taxes owing for individuals are due by April 30th, even though the filing for self-employed people is June 15th.

Don’t fear the tax man

Taxes don’t have to feel like a ball of anxiety every year. When you understand the rules and regulations and work with an expert — filing your taxes is simple. All you have to do is gather the right forms and receipts, and your accountant works their magic for you.

CONTACT US

Unit 215 — 5455 152 Street

Surrey, BC V3S 5A5

Canada

LINKS

CLIENTS

Easy and secure file sharing.

Simply drag and drop your financial documents into the client portal. Your documents will be kept confidential and secure. You will receive a confirmation email when Bridex Accounting Services has received the documents.